Recently, the oracle sector has been on the rise, with token projects represented by UMA, API3, and others experiencing high growth rates. This article will conduct an in-depth analysis of the oracle market and explore investment opportunities.

UMA and API3 Have Seen a Significant Increase, Leading to a Surge in the Market for Oracle

As one of the first blockchain oracle projects, Chainlink has attracted market attention since breaking through $9 last year, while another oracle TRB surged 50 times last year, becoming one of the currencies with the largest growth in the crypto field.

Last year, the prosperity of blockchain oracle machines such as Chainlink and TRB once again attracted attention to the concept of blockchain oracle. However, this year, veteran oracle tokens such as UMA and API3 have also risen, becoming another hot field after the inscriptions and Bitcoin ecosystem.

According to the Gate market, as of the writing date, UMA (UMA) has risen nearly 240% in the past 5 days, with the latest quote of $5.26 and a 4.04% increase in the past 24 hours.

Source: Gate.io

In addition to some lower market value oracle tokens that have seen significant price increases, we have also noticed that high market value old tokens such as PYTH (PYTH), API3 (API3), RLC (IExec RLC) have also seen astonishing growth, becoming popular projects pursued by investors in recent times.

According to real-time data from CoinGecko, the total market value of crypto assets belonging to the oracle category reached $11.3B, including 42 tokens, ranking 25th in total market value.

New Product Releases and Low Selling Pressure Stimulate UMA to Soar

The recent official announcement of new products by UMA has become an important trigger for recent fund speculation in UMA.

UMA Protocol released a tweet on January 19th, hinting at the launch of a new product next week aimed at recovering tens of millions of dollars in annual lending protocol losses caused by MEV. This news has driven UMA prices up 241%, from $1.97 to $6.73, reaching the highest market value since mid-2022.

Source: @UMAprotocol

In fact, according to subsequent observations, UMA officials have indicated that this future product will focus on protecting lending protocols, while co-founder Hart Lambur has explicitly stated that this solution is expected to be launched next week.

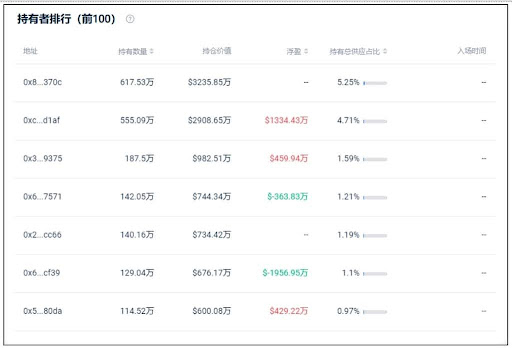

In hindsight, 87% of UMA circulation is held by the top three addresses, including cross-chain bridges, voting pool, and official addresses, which are limited by staking policies and cannot be proposed in the short term; And the remaining 13% of the tokens are mostly held by a few coin holding addresses.

Source: AICoin

As a result, with the continuous improvement of the crypto macro environment, the basic direction of UMA being good, and minimal selling pressure, the coin quickly gained hype, and its market value skyrocketed to the third place in the sector, only behind LINK and PYTH.

However, PYTH, API3, and others have also received attention and popularity due to the expected airdrop, which is the same idea as the market speculation of TIA staking to obtain airdrops recently. We will not elaborate further.

Rotating hotspots, Unchanging Oracles

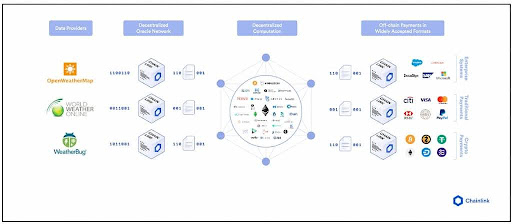

As is well known, oracle is a key technology for integrating real-world data with blockchain, providing blockchain with the ability to obtain and verify external data.

In the previous bull market cycle, Chainlink, the leader in the field of oracle, surged due to the popularity of DeFi Summer.

Nowadays, with the popularity of RWA, Gamble, new DeFi and other tracks, as well as the resurgence of emerging fields such as DID and NFT, the demand for oracle will also increase.

As a bridge connecting blockchain and the real world, oracle has enormous potential in future development. With the continuous progress of blockchain technology and the expansion of application scenarios, the application fields of oracle will also be further expanded. In addition to fields such as finance, insurance, supply chain, and the Internet of Things, oracle is also expected to play an important role in cross chain interoperability.

With the increasing demand for interoperability between different blockchain networks, oracle is expected to become one of the key technologies for achieving cross chain data transmission and verification. Through oracle, different blockchain networks can be connected to each other, achieving data sharing and verification, thereby breaking existing isolation and improving the liquidity and efficiency of the entire blockchain ecosystem. This will bring more possibilities for the application and development of blockchain technology.

Currently, the biggest challenge faced by oracle is how to ensure the reliability and credibility of data sources. Due to the fact that many oracles still rely on off-chain data, which is generated under centralized mechanisms, achieving a perfect oracle still requires a long process of development.

Source: Chainlink

To address this issue, many developers are exploring more efficient and secure oracle solutions. This indicates that there is still a lot of potential for development and innovation in old pricing systems like Chainlink, as well as in niche oracle projects like UMA. Of course, this also provides speculators with room for imagination to participate in speculation.

In short, as a bridge connecting blockchain and the real world, oracle has broad development prospects and infinite possibilities in the future. Through continuous exploration and innovation, we are expected to witness the emergence of more efficient, secure, and practical oracle technology, bringing more opportunities and challenges to the application and development of blockchain technology.